Changes to the Stage Three Tax Cuts Explained

In January 2024, the Government announced changes to the Stage 3 tax cuts that were legislated to begin on 1st July 2024.

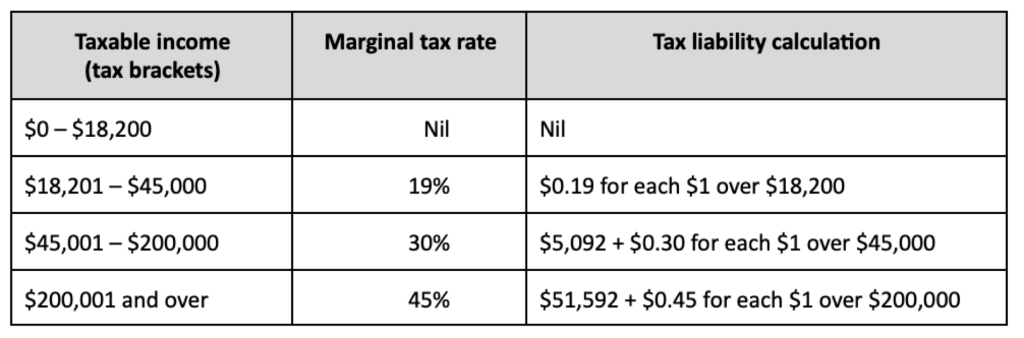

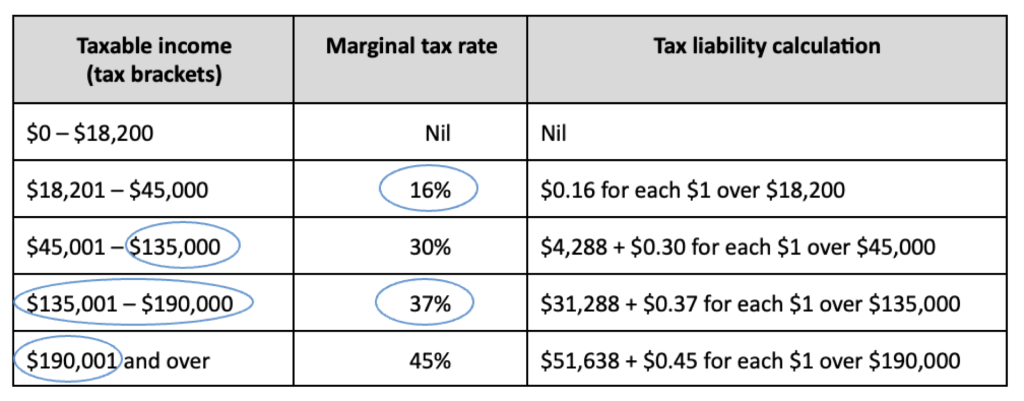

Tables showing both the originally legislated tax brackets as well as the newly proposed ones are below:

Currently Legislated Tax Rates

Tax Rates Under the Proposed Stage 3 Tax Cuts

The differences are:

- the 19% tax rate will change to 16%;

- the 30% tax bracket will stop at $135,000 instead of $200,000

- A 37% tax rate will be payable payable for income between $135,001 and $190,000.

- The 45% tax rate will now apply to all income over $190,001 instead of for income above $200,001.

The benefit of the proposed changes will apply to those individuals with taxable income of below $146,000 who will receive a larger tax cut than they would have under the currently legislated tax cuts.

The Government has released a fact sheet showing the tax cuts for individuals and families based on varying levels of income. You can check your estimated tax cut at this link - Tax cuts to help Australians with the cost of living (treasury.gov.au).

The treasury website also has a calculator you can use to work out your tax cut under the new rates compared to the 2023/2024 tax rates, see here - Tax cut calculator | Treasury.gov.au

The government will also be increasing the Medicare levy low-income thresholds for the 2023/2024 financial year to $24,276, meaning no one who earns below this level of income will need to pay the Medicare levy, and individuals earning between $24,277 and $30,345 will pay a reduced amount.

Examples

Taxpayers in the 16% Tax Bracket

Taxpayers earning $30,000 will receive a tax cut of $354 when comparing the new tax rates for 2024/2025 to the current 2023/2024 tax rates. There will be no difference in their tax amount when comparing the tax between the currently legislated stage 3 tax cuts and the proposed stage 3 tax cuts.

Taxpayers in the 30% Tax Bracket

For taxpayers in the 30% tax bracket, they will receive an additional tax cut of $804 when comparing the currently legislated tax cuts to the proposed tax cuts. The tax cuts that would be received would range from $804 for someone earning $45,000 to $3,379 for an individual earning $130,000.

Taxpayers in the 37% Tax Bracket

Most taxpayers in the 37% tax bracket will actually end up with a smaller tax cut under the new proposed tax rates than they would have under the currently legislated tax cuts. For example, an individual on $150,000, while they will be paying $3,729 less tax overall between the 2023/2024 tax rates and the new proposed tax rates, will end up paying $246 more than they would have under the currently legislated tax cuts. For individuals earning $190,000, the difference in tax between the currently legislated rates and the proposed rates will be around $3,000.

Taxpayers in the 45% Tax Bracket

All taxpayers in the 45% tax bracket will end up receiving a tax cut of around $4,500 less than they would have under the currently legislated tax cuts. This means that instead of receiving a tax cut of around $9,000 as originally legislated, they will now receive a tax cut of $4,529 when compared to the 2023/2024 tax rates.

For more information on how these changes affect you, please click Contact Us below to get in touch.